wichita ks sales tax calculator

Press J to jump to the feed. Sales Tax Table For Wichita County Kansas.

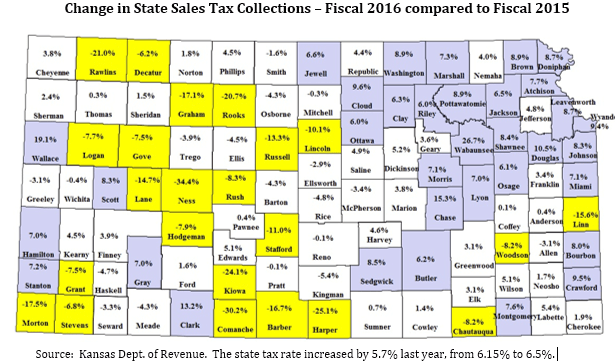

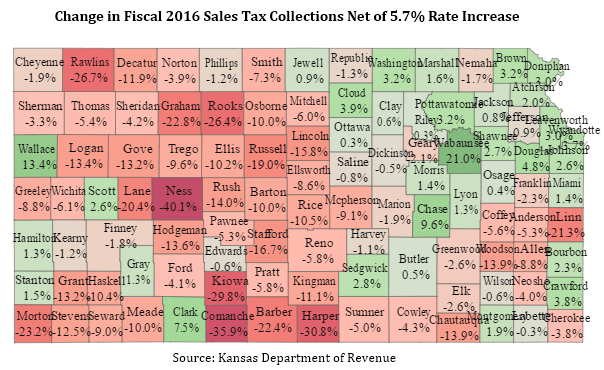

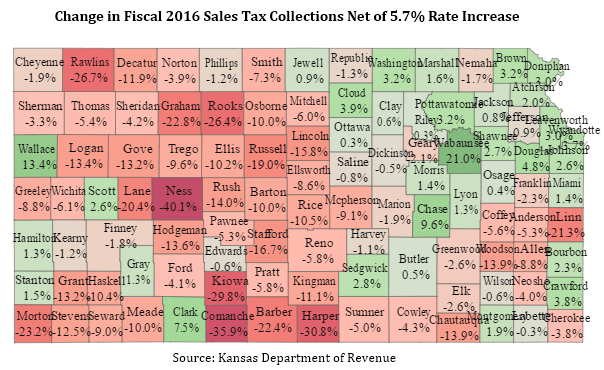

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute

If youre an online business you can connect TaxJar directly to your shopping cart and.

. The minimum combined 2022 sales tax rate for Wichita Kansas is. Calculate the proper tax on every transaction. 1530 N Smith Cir Wichita KS 67212 105900 MLS 614989 Well kept condo located in Westwood Village.

You can find more. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 85 in Wichita County Kansas. Sales Tax State Local Sales Tax on Food.

Accurately file and remit the sales tax you collect in all jurisdictions. Sales Tax Calculator of Kansas for 2021 The state general sales tax rate of Kansas is 65. The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used.

Sales tax in Wichita County Kansas is currently 85. Integrate Vertex seamlessly to the systems you already use. Is there a vehicle property tax that is paid every year along with registration fees.

The Wichita Kansas sales tax rate of 75 applies to the following 28 zip codes. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. Ad Automate your sales tax process.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. What is the sales tax rate in Wichita Kansas. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your.

The current total local sales tax rate in Wichita County KS is 8500. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Wichita KS. The sales tax rate for Wichita County was updated for the 2020 tax year this is the current sales tax rate we are using in the.

Real property tax on median. The current total local sales tax rate in Wichita KS is 7500. Kansas has a 65 statewide sales tax rate but.

Cities andor municipalities of Kansas are. The December 2020 total local sales tax rate was also 7500. Tax credits itemized deductions and.

Your household income location filing status and number of personal exemptions. Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Moved From out state and was curious how tags work on Kansas. The December 2020 total local sales tax rate was also 8500.

The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county. 3 beds 2 baths 1320 sq. How is Kansas sales tax calculated.

This is the total of state county and city sales tax rates.

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

New Mexico Among States Cutting Corporate Income Tax Rates In 2017 Albuquerque Business First

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Texas Sales Tax Calculator Reverse Sales Dremployee

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Kansas Food Sales Tax Kc Healthy Kids

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

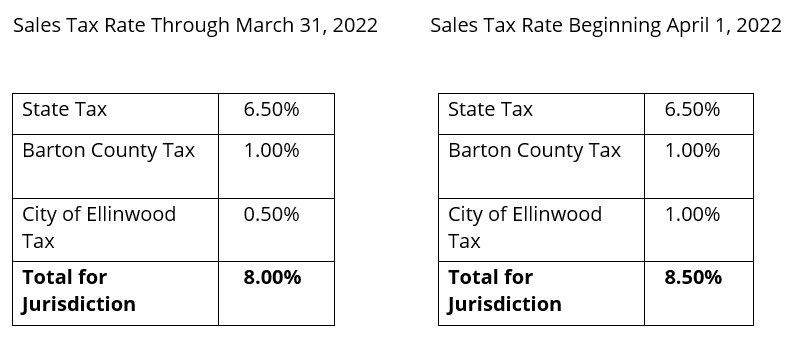

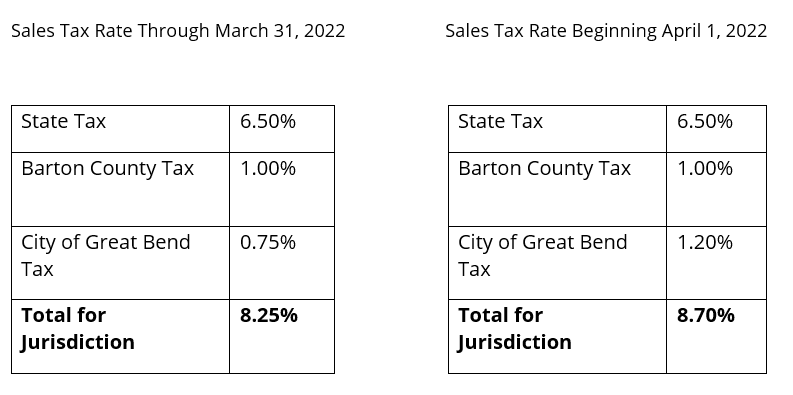

Great Bend Ellinwood Kansas Sales Tax Increases On April 1 2022 Adams Brown

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Great Bend Ellinwood Kansas Sales Tax Increases On April 1 2022 Adams Brown

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Kansas Food Sales Tax Kc Healthy Kids

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute

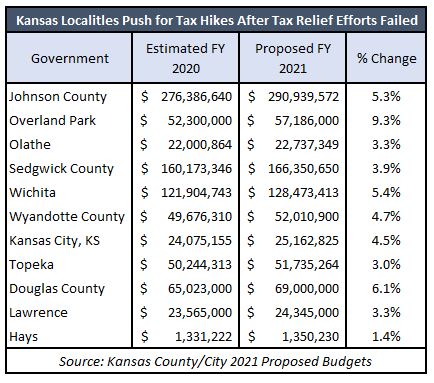

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute